The latest news on ITA Airways’ sale

With the commencing of the new year, the Italian media reported the “usual rumours” regarding the government’s plan to sell its stakes in the national flag carrier, to another European airline group. This tale may sound familiar to many since it constantly repeated year after year, without leading to any formal decision and postponing the issue to the following year, with the hope that a new coalition government would solve it.

A320s parked in Milan Linate featuring ITA Airways and Alitalia liveries

Why is the Italian flag carrier constantly looking for a new acquirer?

Following Etihad Airways’s relaunch plan failure in 2017, the Italian carrier, previously branded Alitalia, filed for Chapter 11 to restructure and deleverage its balance sheets. As it was easily predictable, Alitalia failed to succeed in any target over the two years established for the restructuring plan. Nevertheless, in the meantime, the Covid-19 pandemic shocked the air transport industry generating the worst crisis that ever occurred in the modern aviation industry. In Europe, many national governments allocated significant funds to airlines to support them during the lockdown period and to boost their economic recovery. Thus, also the Italian administration provided Alitalia with subsidies in the form of loans to deal with its operations costs during 2020. On the other hand, Alitalia, unlike other European carriers such as Lufthansa and Air France-KLM, was already experiencing a severe economic crisis before the outbreak of Covid-19. Thus, the European Commission authorised the Italian government to economically support Alitalia under the conditions of implementing a discontinuity plan (including the rebranding of Alitalia), which would have led to the sale of the airline to a private owner.

ITA Airways and Lufthansa aircraft parked in Rome Fiumicino

Will they find an acquirer by 2023?

Between 2021 and 2022 the Italian government capitalised ITA Airways by allocating €1.2 billion, which has been partially used to renovate the ageing fleet inherited by Alitalia, and mostly to cover the day-to-day operating costs. Besides, ITA Airways struggles to reach breakeven (as Alitalia did in the past) and generates significant financial losses that will lead it to bankruptcy, if the carrier will not change its business plan.

According to the Italian newspaper Corriere della Sera (2022), ITA Airways is worth roughly €550 million in January 2023, with forecasts indicating that its cash liquidity is expected to decrease to €280 million by July 2023 and to €100 million by the end of 2023.

In 2022, the Italian government undertook a negotiation process with two competing groups: Lufthansa-MSC and Delta Airlines-Certares. Nevertheless, they did not reach any agreement and at the beginning of 2023, another period was opened for bids by private investors through a governmental decree. According to the Italian media, Lufthansa will likely acquire the 40% of ITA Airways’s equity, since it is the most solid investor that could eventually take over the airline.

Austrian Airlines, Brussels Airlines, Eurowings, Lufthansa and Swiss aircraft tails

Lufthansa’s restructuring method success

The Lufthansa Group conducted several acquisition plans over the years the 2000s, taking over the flag carriers of Switzerland, Austria and Belgium. In particular, in 2005 the German group acquired an 11% stake in Swiss, the successor of Swissair (bankrupted in 2001), completing the takeover of the 100% stake in 2007. Furthermore, in 2008 they purchased 45% and 41.6% of the equity of Brussels Airlines and Austrian airlines respectively, which were both bankrupted in the previous years.

Thanks to the synergies developed by Lufthansa through a common market strategy, the acquired company first recovered from their crises and positioned itself as the market leader in their national air transport systems. Furthermore, Lufthansa’s group hub and spoke model comprises not only Frankfurt and Munich airports but also Zurich, Vienna and Brussels, each of them specialised in a specific market, such as Africa for Brussels, Eastern Europe and Asia for Austrian Airlines.

Lufthansa’s destinations available from Frankfurt airport in 2023

Why is Lufthansa interested in acquiring ITA despite all the losses?

“Italy is one of the most important markets for us”

Carsten Spohr (Lufthansa CEO, 2022)

Italy represents a crucial market for Lufthansa since the airline transported more passengers from the US to Italy rather than Germany. Thus, the German carrier wants to boost its predominance in Europe expanding its operations to the Italian market which is partitioned between low-cost airlines, Air France-KLM and IAG group (including Aer Lingus, British Airways, Iberia, Level and Vueling). To achieve this milestone, Lufthansa will manage 5 hubs located in Central and Southern Europe, conveying connecting passengers to either one of these airports depending on their final destinations.

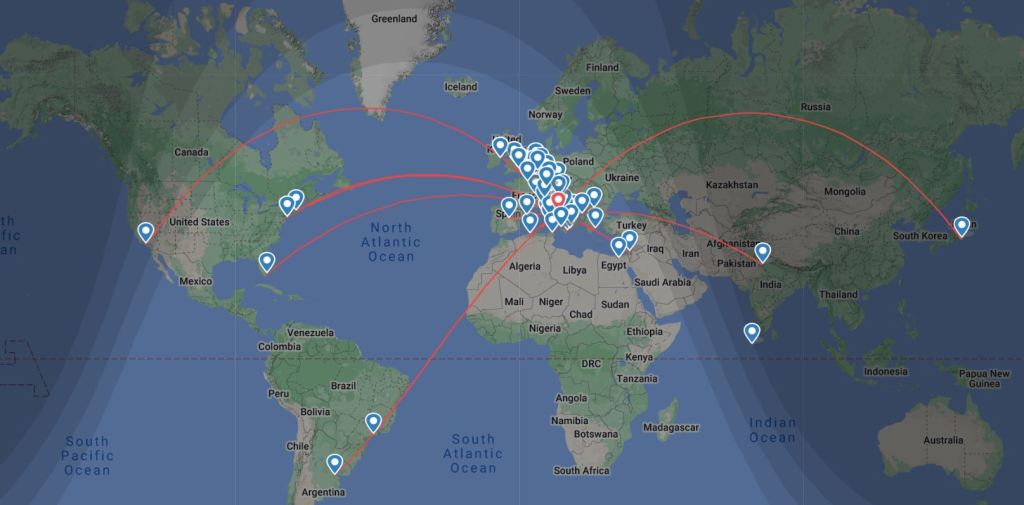

ITA Airways’ long-haul network in 2023 from its hub in Rome Fiumicino

Will it work?

The network plan, rumoured by experts, highlights that the operations should be mainly concentrated on Rome Fiumicino as the primary hub for long-haul flights, with a particular focus on connections to South America and Africa; while Linate (Milan’s third airport for passengers volumes) would handle short-haul flights.

Following this scheme Malpensa (Milan’s largest airport) would likely maintain its daily flight to New York JFK, without playing a key role for the airline. Therefore, Lufthansa would not develop the hub of Milan Malpensa to avoid competition with its hubs of Frankfurt, Munich and Zurich (the latter is located close to Milan). Passengers flying from Northern Italy will have to use connecting flights to reach any long-haul destinations.

Despite its solid structure, Lufthansa will find many obstacles in making ITA Airways a key player in the Italian market, due to the massive presence of low-cost airlines (Ryanair, EasyJet and Wizzair) and due to the traffic seasonality of Rome’s air transport market.