As 2025 eventually began, aviation analysts started collecting data to define and assess air transport trends recorded during the previous year. In particular, 2024 confirmed strong passenger growth in the air transport market worldwide for the fourth consecutive year, forecasting a positive outlook for 2025.

The following article presents some analyses regarding the current features of the European air transport market and an overview of the next decade’s projections.

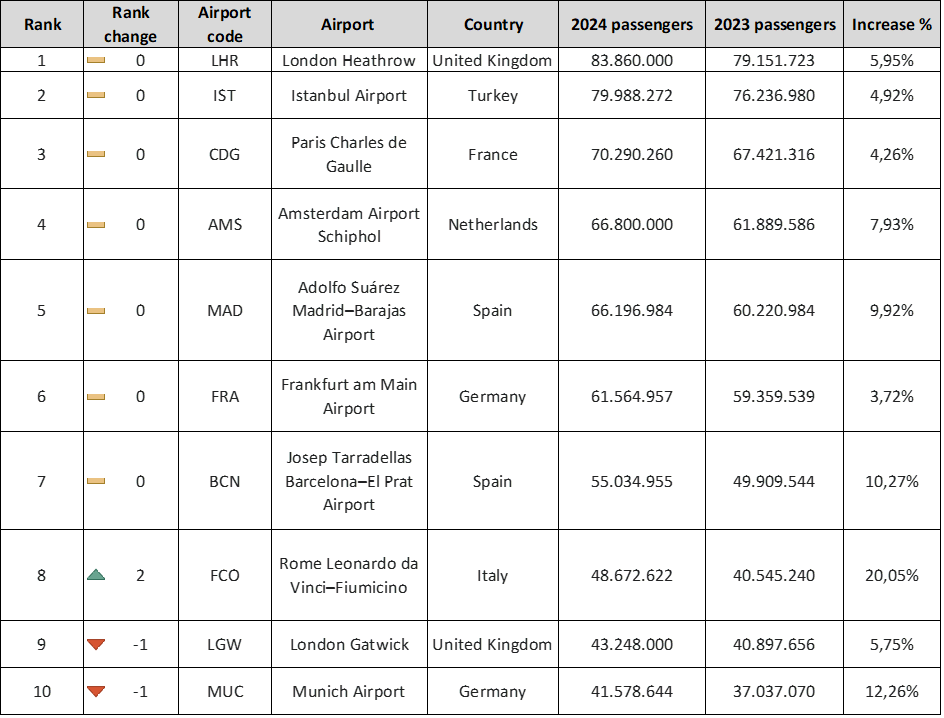

Top ten busiest airports

The four busiest airports in Europe for 2024 are confirmed to be London (LHR), Istanbul (IST), Paris (CDG) and Amsterdam (AMS), which led the ranking for decades, as they are among the largest hubs worldwide.

London is undoubtedly one of the largest air transport systems ever, with Heathrow representing the cutting edge of the British aviation economy (and the hub of British Airways, the leading European partner of IAG group), as the airport can handle over 83 million passengers a year with just two runways.

Istanbul Havalimani is the most recently built airport in the ranking, as it commenced operations in 2019 replacing Ataturk Airport. Havalimani was designed to provide Turkish Airlines with the needed capacity to implement the carrier’s growth plan, which consists of becoming the largest airline worldwide for destinations served.

Paris Charles de Gaulle and Amsterdam Schipol airports are the hubs of the Air France-KLM company and they play a key role in their partnership as the airlines develop a complementary network of destinations between the two hubs.

Hub & spoke model

Although Barcelona El Prat and London Gatwick airports do not feature a proper hub-and-spoke system, they still rank among the ten busiest airports in Europe. Moreover, several low-cost carriers in these airports are based which leverage consistent traffic flows, especially during the Summer season.

On one side, Barcelona hosts the base of Vueling and Level which fly to over 100 destinations in the medium and long-haul respectively. Despite, being low-cost carriers, Vueling and Level offer connecting flights between them, developing niche hub & spoke models boosting El Prat’s yearly passenger flows.

On the other side, London Gatwick is the historic home of Easyjet which has an extensive European network, operating point-to-point services. Over the last few years, Easyjet implemented some transit options in Gatwick airports, however, being a low-cost carrier, the offer is limited and partly supports the airport passenger numbers.

Thus, one may wonder how these two airports rank among the top 10 busiest airports, and the answer is pretty straightforward. El Prat is the only airport in Barcelona, and since the city is one of the major tourist attractions in Europe, BCN handles consistent traffic flows every year. While London is the largest aviation market in Europe with over 180 million passengers a year, each of London’s airports is specialised in a different market segment, in the case of LGW it currently is Britain’s largest base for low-cost carriers.

Bottom line

As depicted in the previous graph, air traffic flows are set to constantly grow during the next years, led by increasing passenger demand. The main challenge for European airports will be enhancing their infrastructure and increasing their capacity to handle more and more passengers.

As of 2025, Istanbul Havalimani is the only airport of the ranking previously discussed that is developing impressive expansion infrastructure, targeting over 200 million passengers in transit a year. In contrast, London Heathrow is subject to capacity constraints due to its limited runway movements and the surrounding urban area. Therefore, we may see some changes in the ranking during the next decade.